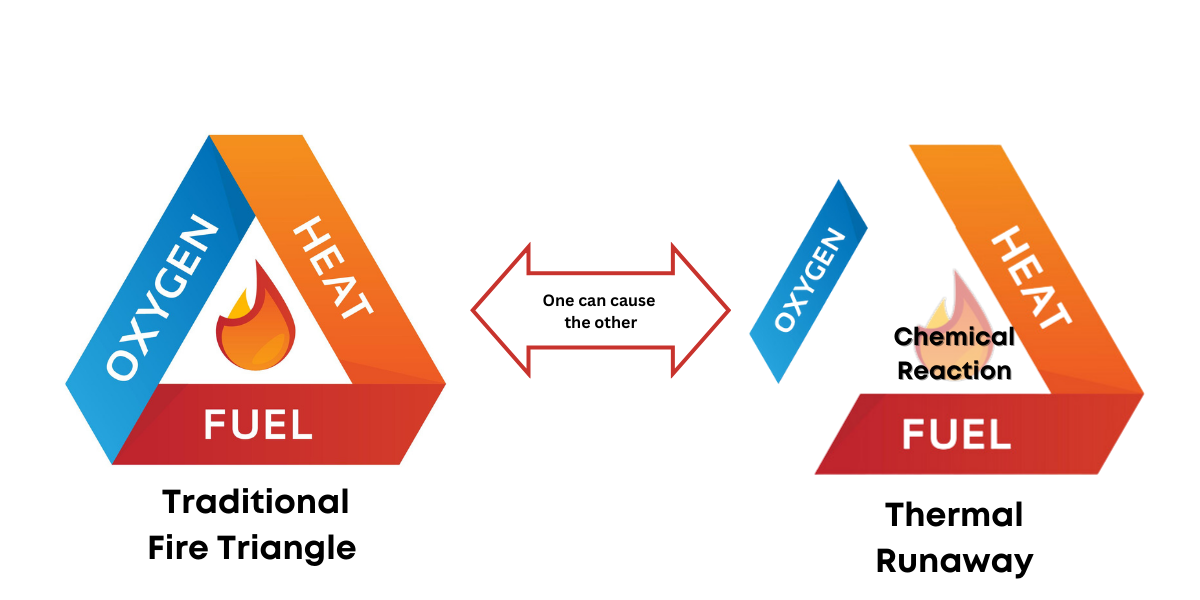

Figure 2: The ‘traditional’ fire triangle and its relationship to Thermal Runaway

To fully grasp the complexity of thermal runaway, it's essential to understand its progression. The process typically unfolds in three distinct phases, each with its own characteristics and challenges:

Initial Instability: A voltage or temperature instability occurs, and the cell begins emitting gases.

Internal Short Circuit: The voltage drops to zero as internal cell materials fail, and the anode and cathode experience a direct internal short. The stored electrical energy in the battery flows through this short, causing temperatures to spike as high as 300-600°C. Importantly, visible flame may or may not occur at this stage.

Consumption of Cell Materials: As the internal materials of the cell are consumed, the thermal runaway event can transition to consuming the cell's encasing materials such as the electrolyte, polymers, and plastics surrounding the cell. The gaseous emissions at this stage are consistent with a plastic fire.

Understanding what triggers thermal runaway is equally important as recognizing its phases. Several factors can initiate this dangerous process:

Electrical Abuse: Overcharging or over-discharging batteries can lead to undesirable electrochemical reactions. When batteries are charged beyond their specified voltage range, it can result in electrolyte decomposition on the cathode surface, increasing battery temperature. Excessive lithium-ion migration during overcharging can destabilize the cathode, potentially initiating thermal runaway.

Mechanical Abuse: External damage to Li-ion batteries, such as impacts, indentations, or punctures, can compromise the integrity of the cell. If the casing is damaged, air can enter and react with the active components and electrolyte, generating heat. Severe internal damage can also lead to short circuits within the cell.

Internal Failures: Manufacturing defects or degradation over time can lead to internal short circuits, generating enough heat to initiate thermal runaway. These failures are particularly challenging, as they are hard to detect with external inspections.

Once thermal runaway begins in a single cell, it can quickly escalate into a cascading failure affecting neighboring cells and potentially the entire BESS installation. The heat generated by the failing cell can raise the temperature of adjacent cells, pushing them into thermal runaway as well. Additionally, failing cells can release flammable and toxic gases, further exacerbating the situation.

The consequences of a thermal runaway event in a large-scale BESS can be catastrophic. High-profile incidents have resulted in significant property damage, extended system downtime, and in some cases, injuries to first responders. These events not only pose immediate safety risks but also have broader implications for public perception and regulatory scrutiny of BESS technology.

Despite these challenges, it should be noted that the BESS industry has made significant strides in understanding and mitigating the risks associated with thermal runaway. As manufacturers, operators, and regulators gain more experience with large-scale BESS deployments, they have been able to identify common failure modes and develop more effective mitigation strategies.

Risk Mitigation Strategies and Best Practices

The BESS industry's approach to risk mitigation, particularly regarding fire protection and suppression, has undergone a significant evolution over the past eight years. This journey reflects the industry's growing understanding of the unique challenges posed by large-scale battery installations.

The landscape changed dramatically following a series of fires in Korea in 2017 and 2018. These incidents prompted a shift towards gaseous fire suppression systems in containerized units and dedicated BESS rooms. The theory was simple: remove oxygen from the environment to suppress fires effectively. However, the limitations of this approach became apparent with the APS Surprise, Arizona event in 2019, where quelled fires reignited upon the reintroduction of oxygen into the system.

In response to the Surprise, AZ incident, many fire departments and authorities began requiring water-based fire protection systems for BESS installations. Yet, several events since 2020 have revealed flaws in relying solely on water-based systems, particularly in remote locations where water availability can be limited.

Today, the industry has come full circle, returning to an approach that echoes the pre-2017 era but with pivotal enhancements, specifically the mandatory inclusion of Battery Management Systems (BMS). These systems are the nerve centers of modern BESS installations, playing a role in both performance optimization and safety management. BMS provides sensing and control of critical parameters, and importantly trigger protective or corrective actions if the system is operating out of the norm. These parameters include battery module over or under voltage, cell string over or under voltage, battery module temperature, temperature signal loss, and battery module current. In the event of any abnormal condition, the BMS will first raise an information warning and then trigger a corresponding corrective action should certain levels be reached.

While the Battery Mangement System is an essential component of BESS safety, a comprehensive approach to risk management includes several other best practices:

Spatial Separation and Explosion Relief: Effective explosion relief systems require design conformance to NFPA Standards and sufficient spatial separation between containers or structures to avoid collateral damage. The standard minimum distance for non-sprinklered LFP containers is 6 feet.

Multi-Layered Approach to Fire Protection: While the emphasis is on prevention, many installations still incorporate fire suppression systems as a last line of defense. This may include a combination of gaseous suppression, water-based protection, and emerging coolant-based systems.

Adherence to Evolving Standards: Compliance with applicable fire and building codes provides a basis for resilience. As these standards continue to evolve, BESS operators must stay informed and adapt their systems accordingly.

Conforming to these best practices is not just a matter of regulatory compliance; it's necessary for the long-term viability and growth of the BESS industry. As energy storage becomes increasingly central to our power infrastructure, the safety and reliability of these systems directly impact public trust, regulatory support, and investor confidence. BESS operators who prioritize these best practices not only mitigate their own risks but also contribute to the overall resilience and reputation of the industry. Moreover, as insurers and regulators scrutinize BESS installations more closely, those adhering to best practices are likely to find themselves in a more favorable position for insurance coverage and regulatory approval.

Beyond Compliance: Proving Resilience to Insurers

For battery storage asset owners, navigating the insurance landscape can be as complex as the technology itself. Insurers are looking beyond mere compliance; they seek evidence of a comprehensive, proactive approach to risk management. The following areas are critical for positioning BESS projects favorably in the eyes of underwriters:

Prove Preparedness

Insurers want evidence of active prevention rather than not just reaction to potential issues, but actively preventing them. This starts with your Battery Management System (BMS). Asset owners should be prepared to demonstrate how the BMS goes beyond basic monitoring, showing its capability to detect subtle anomalies that might precede a thermal runaway event and, crucially, how it autonomously implements corrective actions.

Remote monitoring is no longer a luxury—it's a necessity. Insurers are looking for systems that provide real-time, granular data on battery performance. The monitoring setup should allow for rapid intervention before small issues become major incidents.

Design for Safety

The physical layout of BESS installations significantly impacts risk assessment. Insurers are particularly interested in spatial separation between enclosures. While a minimum of 8 feet (already more conservative than NFPA code standards) is often cited as a benchmark, asset owners should be prepared to justify their chosen configuration based on specific risk assessments.

Fire suppression systems remain critical, but the approach must be tailored to the specific installation. Asset owners should be ready to explain the rationale behind their chosen system—whether gaseous, water-based, or an emerging technology—and how it's optimized for the specific setup and location.

Commitment to safety should extend beyond technology. Insurers look favorably on projects that engage experienced O&M providers familiar with regional specifics. Demonstrating coordination with local fire departments, including specialized training programs tailored to the BESS installation, is important.

Chemistry Considerations

Battery chemistry choice significantly impacts the risk profile. While Lithium Iron Phosphate (LFP) batteries are generally viewed favorably due to their stability, other chemistries may be beneficial depending on the use case.

Comprehensive Documentation

Thorough documentation is crucial. Insurers like to see:

This information should be contextualized to demonstrate how each element contributes to the overall risk mitigation strategy.

The Path Forward

The BESS industry stands at the cusp of a transformative era, with rapid growth driven by technological advancements and the pressing need for sustainable energy solutions. As deployments scale up, emerging technologies like artificial intelligence and advanced data analytics are reshaping how we approach battery management and risk mitigation.

This technological revolution, however, must be balanced with a thorough understanding of the risks inherent to BESS. The industry's future hinges on our ability to build resilience into every aspect of BESS design, operation, and insurance. From innovative battery chemistries to sophisticated monitoring systems, each advancement plays a crucial role in enhancing safety and reliability.

As insurers and operators gain more experience and data, we’re seeing a shift towards more nuanced risk assessments and tailored insurance solutions. In this evolving landscape, brokers play a pivotal role. They should be proactively seeking detailed information and documentation from their clients and marketing these accounts across the insurance market. Not all insurers are equipped to make price adjustments based on resilience measures, making it crucial for brokers to work with those who have their arms around this risk class.

Looking ahead, there is reason for optimism for the battery energy storage. The industry has shown adaptability in the face of adversity, and the collaborative efforts between developers, brokers, and insurers are paving the way for safer projects. Carriers are only likely to become smarter and more comfortable with storage as the technology matures. By continuing to prioritize resilience, embracing innovative risk management strategies, and communicating with the insurance markets, we can ensure that BESS continues to play a vital role in our clean energy future, powering us toward a more sustainable and secure energy landscape.

[1] https://www.kwhanalytics.com/solar-risk-assessment

[2] https://www.epri.com/research/products/000000003002030360

[3] https://www.researchgate.net/profile/Edmund-Fordham/publication/359031670_Safety_of_Grid_Scale_Lithium-ion_Battery_Energy_Storage_Systems/links/62236da03c53d31ba4a9404b/Safety-of-Grid-Scale-Lithium-ion-Battery-Energy-Storage-Systems.pdf