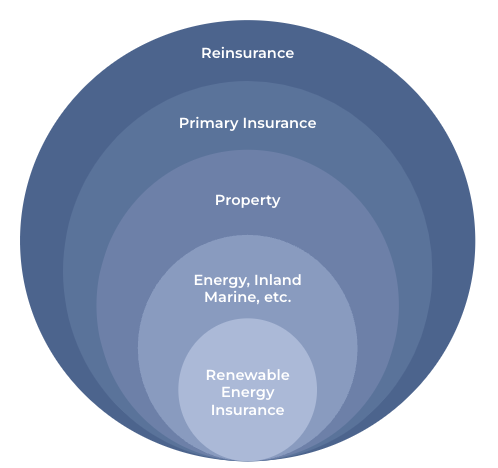

Capacity supports renewable energy growth to fight climate change

San Francisco, CA, [DATE] - kWh Analytics, Inc., the industry leader in climate insurance, announced today a significant increase in its capacity agreement with Aspen Insurance (“Aspen”) to support its property insurance offering for renewable energy projects. With this increase, kWh Analytics is able to underwrite up to USD$75 million per renewable energy project location and has full delegated authority to cover accounts compromising up to 100% of operational solar and/or battery energy storage systems (BESS) projects and up to 50% of wind and/or construction accounts.

kWh Analytics’ capacity increase comes one year after the company partnered with Aspen to launch property insurance underwriting and capacity for renewable energy assets in January 2023. In addition to this increase, kWh Analytics and Aspen now have four of the top ten global (re)insurance partners on their panel.

Jason Kaminsky, CEO at kWh Analytics, said: “This capacity raise is a strong indicator of confidence in our company’s data and sophisticated modeling capabilities and the industry’s desire to encourage resilient renewable assets. Adding capacity enables us to expand coverage options for responsible asset owners, supporting renewable energy growth amidst worsening natural disasters by incentivizing resilience and bridging the protection gap.”

Josh Jennings, SVP and Head of Inland Marine at Aspen Insurance, said: "kWh Analytics' data-driven approach is consistent with Aspen’s future-focused underwriting strategy, and we’re delighted to continue our collaboration to meet our clients’ evolving needs with innovative renewables solutions. This increased capacity provides additional options for asset owners who are proactively designing, building and maintaining resilient assets, and it further strengthens our commitment with kWh Analytics to offer solutions for the growing demands of the renewable energy market.”

Recent years have seen reduced limits and substantial cost increases for renewable asset owners, amidst a growing need for new solutions to manage and underwrite risk. kWh Analytics uses its proprietary database of over 300,000 renewable energy assets to accurately price and underwrite unique risk transfer products, as well as reward asset owners for resiliency measures. This year, kWh Analytics launched a microcracking endorsement for solar assets that simplifies the insurance claims process for this common but difficult-to-assess form of solar module damage.

In addition to its insurance products, kWh Analytics is leveraging data to encourage resilient design practices and to identify the most common failure modes among existing solar PV projects. The findings, which are incorporated in property insurance underwriting, are distributed to the company’s clients and broadly to manufacturers, operators, carrier partners and investors to reinforce the further development of sustainable renewable energy projects.

ABOUT KWH ANALYTICS

kWh Analytics is a leading provider of Climate Insurance for zero carbon assets. Utilizing their proprietary database of over 300,000 operating renewable energy assets, kWh Analytics uses real-world project performance data and decades of expertise to underwrite unique risk transfer products on behalf of insurance partners. kWh Analytics has recently been recognized on FinTech Global’s ESGFinTech100 list for their data and climate insurance innovations. Property Insurance offers comprehensive coverage against physical loss, with unique recognition and consideration for site-level resiliency practices, and the Solar Revenue Put production insurance protects against downside risk and unlocks preferred financing terms. These offerings, which have insured over $23 billion of assets to date, aim to further kWh Analytics’ mission to provide best-in-class Insurance for our Climate. To learn more, please visit https://www.kwhanalytics.com/, connect with us on LinkedIn, and follow us on Twitter.

About Aspen Insurance Holdings Limited

Aspen provides insurance and reinsurance coverage to clients in various domestic and global markets through wholly-owned operating subsidiaries in Bermuda, the United States and the United Kingdom, as well as its branch operations in Canada, Singapore and Switzerland. For the year ended December 31, 2023, Aspen reported $15.2 billion in total assets, $7.8 billion in gross loss reserves, $2.9 billion in total shareholders’ equity and $4.0 billion in gross written premiums. Aspen's operating subsidiaries have been assigned a rating of “A-” by Standard & Poor’s Financial Services LLC and an “A” (“Excellent”) by A.M. Best Company Inc. For more information about Aspen, please visit www.aspen.co.

Media Contact

Nikky Venkataraman

Senior Marketing Manager

kWh Analytics

E | nikky.venkataraman@kwhanalytics.com

T | (720) 588-9361